Liquidity Routing

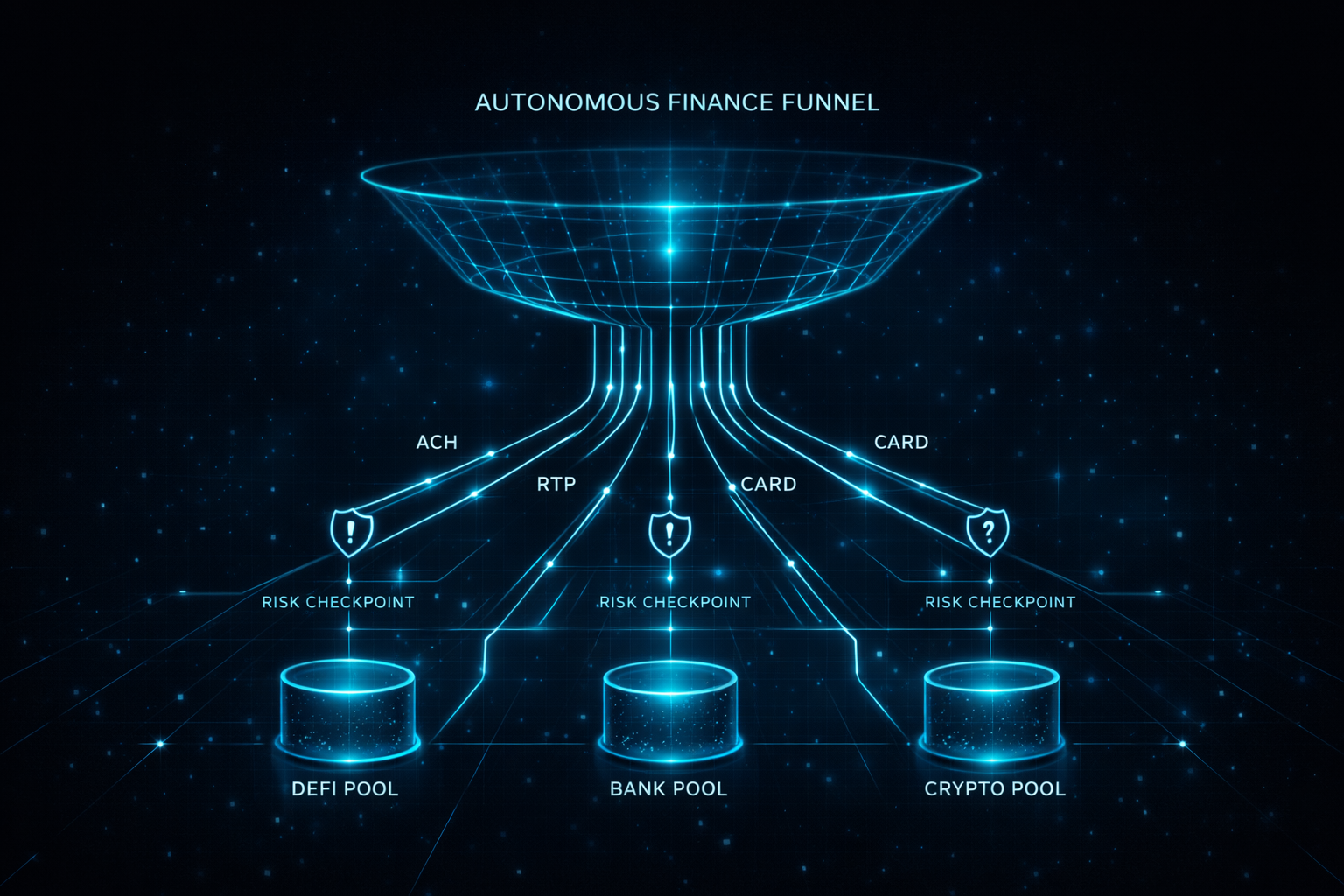

Route funds across banks, exchanges, and DeFi pools with intelligent path selection and execution-aware settling.

- Best-path execution

- Latency-aware routing

- Cross-rail abstraction

TechCoin.ai is an AI-native identity for liquidity routing, real-time risk intelligence, and automated settlement. Built for teams shipping the next generation of finance rails.

A brand system for AI-native finance products — from agentic payments to portfolio routing.

Route funds across banks, exchanges, and DeFi pools with intelligent path selection and execution-aware settling.

Score counterparties and market conditions in real-time — turning risk from reports into live control systems.

Collapse the gap between intent and settlement with programmable workflows and AI-driven execution strategies.

Modern finance is still stitched together: fragmented rails, delayed risk signals, and dense routing decisions.

Funds live across banks, custodians, exchanges, and DeFi — routing is manual, slow, and expensive.

Risk is reported after damage is done. Teams need live scoring + policy enforcement.

Execution is disconnected from intelligence — creating slippage, delays, and operational leakage.

TechCoin.ai is a brand built to anchor products that treat money like data: sensed in real-time, routed intelligently, and settled with execution-aware automation.

TechCoin.ai represents an intelligent funnel that routes transactions across multiple rails while continuously evaluating risk and execution quality.

A console-style narrative you can map directly to product modules: routing, risk, allocation.

Choose best paths across venues using latency + price + policy weighting.

Continuous counterparty + market risk scoring with automated guardrails.

Allocate exposure with volatility-aware policy bands and yield targets.

Automate batch timing, reduce slippage, and generate audit-ready trails.

Use TechCoin.ai as the flagship identity for an AI finance product — or acquire the domain as programmable digital real estate.

Clean, memorable, and fintech-native — built to carry trust and velocity.

Outcomes → Problem/Solution → Demo Rail → Acquire. Built for conversion, not vibes.

Supports future DomainFi / RWA positioning, partnership flows, and lead capture upgrades.

TechCoin.ai is available through structured arrangements — aligned to ownership, partnership, or a defined path to ownership. Terms discussed privately.

Full ownership of TechCoin.ai and brand asset. Best for buyers seeking category authority with clean transfer terms.

Co-develop TechCoin.ai as a shared platform or venture alignment — ideal for operators who see alignment.

12–36 months with a defined path to ownership. Designed for teams validating product direction or capital strategy.

We’ll align the structure to your timeline: buy, partner, or staged acquisition.

Private inquiries only. Acquisition, partnership, or structured lease discussions are handled directly by GhostFire Digital.

We’ll align scope, structure, and next steps confidentially.

Fast answers for acquisition + delivery.